Which Of The Following U.s. Government Securities Are Classified As Money Market Instruments?

The coin market is a component of the fiscal system that provides short-term trading, lending or funding activities with a maturity of up to i year denominated in rupiah or a foreign currency.

When formulating and implementing monetary policy, Bank Indonesia applies monetary controls through the rupiah and foreign currency money markets. To increase the effectiveness of monetary, macroprudential and payment system policy as well equally rupiah currency direction by Bank Indonesia, financial market deepening is required to create efficient, liquid and deep domestic money markets.

Efficient, liquid and deep money markets provide greater flexibility for market place participants to manage funds for funding and investment purposes as well as other economical activities. Therefore, Banking concern Indonesia is required to accelerate the money marketplace deepening process through comprehensive regulations, licensing, development and supervision in terms of the various coin marketplace transactions and instruments.

Money Market Regulations comply with prevailing state treasury laws in terms of utilising regime debt securities (SUN) every bit a monetary musical instrument through budgetary operations based on repurchase agreements (repo). Furthermore, Coin Market Regulations provide a solid legal foundation for market participants as a reference and a form of legal assurance when transacting in the money market.

Fiscal market development must exist balanced with the institution of credible financial markets through efforts to increment market participant competency and integrity. Competency and integrity tin be increased by requiring Market Participants ensure their Directors and Employees are credentialled with treasury certification commensurate with the respective market activity and position, while ensuring implementation of the Market Code of Conduct and membership of a treasury professional clan.

Efforts to increase the competency and integrity of Market Participants also require the support of trusted Professional Certification Institutions. Professional Certification Institutions must apply skillful governance in accordance with prevailing professional person standards in Republic of indonesia, managed by quality human resources with credible experience and acceptable organisational tools.

Bank Indonesia Regulation (PBI) No. 19/5/PBI/2017 apropos Treasury Certification and Market Code of Comport too every bit Board of Governors Regulation (PADG) No. xix/five/PADG/2017 concerning Treasury Certification and Market Lawmaking of Conduct provide clarity apropos market place lawmaking of conduct mechanisms, membership of treasury professional associations, treasury certification commensurate with market activity and position, the criteria of Professional Certification Institutions recognised past Bank Indonesia, equally well every bit reporting obligations by Market Participants and Professional person Certification Institutions.

The main provisions of the regulations are recapitulated as follows:

- The Market Code of Conduct are guidelines for Directors and Employees of Market Participants referring to the codes of ethics published by conventional and Islamic associations/committees in the fiscal services industry. The code of ethics must exist understood and applied past all Directors and Employees of Marketplace Participants, which are required to maintain internal procedures that incorporate the Market Code of Conduct.

- Market participants are required to ensure their Directors and Employees are members of professional associations in accord with conventional or Islamic principles.

- The regulations stipulate the validity period, extensions, positions and maintenance of treasury certification.

- The regulations and provisions concerning organisational tools, certification schemes and assistants of treasury certification by professional certification institutions recognised by Bank Indonesia.

- Reporting requirements for Market Participants and Professional person Certification Institutions to Bank Indonesia.

- Sanctions and penalties for Market Participants and Professional Certification Institutions.

The Market Code of Conduct represents the professional person upstanding norms that must exist maintained or avoided equally behavioural guidelines for the Money Market and Foreign Commutation Market.

To strengthen financial market credibility by increasing market participant competence and integrity, Banking company Indonesia issued Bank Indonesia Regulation (PBI) No. 19/5/PBI/2017 concerning Treasury Certification and Market Code of Conduct as well every bit Board of Governors Regulation (PADG) No. 19/5/PADG/2017 apropos Treasury Certification and Market Lawmaking of Conduct, every bit amended by Lath of Governors Regulation (PADG) No. 21/21/PADG/2019. The regulations were issued to instil a code of conduct in Indonesia.

Statement of Commitment to Market Codes

As stipulated in prevailing regulations, a Statement of Commitment to Market Codes is a class of commitment by Market Participants to implement the Market Code of Deport. Market Participants tin can submit to Bank Republic of indonesia a Argument of Commitment based on the results of internal self-assessment for publication. The Argument of Commitment is a form of institutional delivery to consistently implement the Market Code of Behave in terms of treasury activities.

By adopting the Market Code of Conduct, Marketplace Participants receive the following benefits:

- Broader implementation of the market code of conduct in treasury activities in accordance with international all-time market practices.

- Informing stakeholders likewise every bit domestic and international investors that the institution is committed to implementing the market code of conduct, from which the stakeholders volition receive positive benefits.

- Providing competitive advantage for Market Participants regarding effectiveness and behaviour when transacting.

- Supporting implementation of fiscal market place development policies in Indonesia through efforts to create transparent, effective and resilient financial markets.

Disclaimer

The Statement of Commitment is a form of institutional commitment to consistently implement the Marketplace Code of Comport in terms of treasury activities and, as such, Bank Republic of indonesia bears no responsibleness for the Statement of Commitment.

Marketplace evolution tin be achieved through the advancement of money market instruments in gild to expand the variety of instruments available to marketplace participants. Certificates of Eolith (CD) are an alternative money marketplace musical instrument recently developed.

In March 2017, Bank Indonesia issued Bank Indonesia Regulation (PBI) No. xix/2/PBI/2017 apropos Document of Eolith (CD) Transactions in the Coin Market. As the money market authority, Bank Indonesia regulates, licences, develops and supervises money marketplace instruments, including certificates of deposit (CD), transacted in the money market. Furthermore, the Banking company Indonesia regulation provides a solid legal foundation for market participants to transact with certificates of deposit (CD) in the money market.

In terms of regulatory implementation, Bank Indonesia issued implementation guidelines in the class of a Board of Governors regulation for issuers and marketplace participants transacting with certificates of eolith (CD) in the coin market, roofing aspects of licensing, reporting and supervision.

The salient provisions of the regulation are equally follows:

- Licence application procedures for Banks, Securities Companies and Brokers:

- Equally Issuers of Certificates of Deposit transacted in the Money Market.

- As Transaction Intermediaries for Certificates of Deposit.

-

As Custodians of Certificates of Eolith transacted in the Money Marketplace.

-

Licence application processing:

-

Depository financial institution Indonesia will grant or turn down a licence application in writing within 10 working days upon receipt of a complete application and supporting documentation in line with prevailing regulations.

-

Bank Indonesia volition carry administrative verification of the documentation submitted in accordance with the Bank Indonesia regulation concerning Document of Eolith (CD) Transactions in the Coin Market place and implementation guidelines.

-

Bank Republic of indonesia will acquit further clarification in the grade of:

-

Contiguous meetings with the licence bidder to verify the accuracy of the documents submitted.

-

Request for information from the relevant authorities.

-

Based on the results of the administrative verification, Banking concern Indonesia will decide to:

-

Grant a licence.

-

Data Disclosure

Banks issuing Certificates of Deposit (CD) to be transacted in the Money Market must declare "transactable in the money market" on the front page of the prospectus offered to investors.

-

Reporting

-

Banks, Securities Companies and Brokers must report to Banking concern Indonesia equally follows:

- Certificate of Eolith Transaction Report submitted by a Banking company or Securities Company on behalf of itself.

- Certificate of Deposit Transaction Report submitted by a Securities Company or Broker as intermediary on behalf of a customer.

-

Reports must be submitted to Bank Indonesia through the following mechanisms:

- For Banks, through the commercial bank daily written report arrangement.

-

For Securities Companies and Brokers, through a reporting system in accordance with Depository financial institution Republic of indonesia regulations concerning the reporting of certificate of deposit transactions by securities companies and brokers.

-

Supervision

-

Banking concern Republic of indonesia conducts supervision of Banks, Securities Companies, Brokers as well as Depository and Settlement Institutions in relation to issuances and transactions of certificates of eolith (CD) in the Money Marketplace.

-

Supervision includes:

-

Indirect supervision; and

-

Inspections

Money Market evolution requires the development of money marketplace instruments, including Commercial Securities.

Commercial securities are coin market instruments issued by non-bank corporations with a maturity of up to one year as an alternative form of brusk-term funding or liquidity management bachelor to non-bank corporations. Meanwhile, the evolution of commercial securities every bit a money market instrument will provide greater liquidity management flexibility for Market Participants.

Banking concern Republic of indonesia is authorised to regulate short-term money market place instruments with a maturity period of up to one year in accordance with the provisions stipulated in Article 70 of Police No. viii of 1994 concerning the Capital Marketplace along with the corresponding elucidation. Article lxx states that Commercial Securities are a money marketplace instrument exempt from public offering obligations considering that the development, regulation and supervision of such securities with a maturity menses of upward to one year are conducted by a separate institution.

As the money market place authority, Bank Indonesia regulates the money market and instruments therein through Depository financial institution Indonesia Regulations. In addition, to strengthen money market place credibility as a medium of monetary policy transmission in general and the commercial securities market place in particular, Banking company Indonesia has also regulated commercial securities every bit a money market place musical instrument in accordance with Bank Indonesia Regulation (PBI) No. 19/9/PBI/2017 concerning Issuances and Transactions of Commercial Securities in the Money Market.

The regulations on commercial securities are focused on creating a qualified investor base. Qualified investors have strong investment knowledge and understand the risks. I fashion to create a qualified investor base is by enforcing a lower limit on purchases of Commercial Securities at Rp500 million. Consequently, the Banking company Indonesia regulation distinguishes between qualified and unqualified investors regarding aspects of information disclosure.

Financial markets play a strategic role in terms of funding economic activity, transmitting budgetary and financial policies every bit well as maintaining fiscal system stability. The inquiry literature shows that deep financial markets can accelerate economic growth. Various breakthroughs to back up the fiscal markets are urgently required to enable infrastructure development as a prerequisite for sustainable economic growth. At least 49.98% of full funds in the financial markets are earmarked to support infrastructure development from 2020-2024.

Moving forward, strategic evolution initiatives in Indonesia must seek to create deep and globally competitive fiscal markets, which will provide alternative sources of financing and investment for economical players, while facilitating the risk mitigation needs of market participants and creating transaction efficiency through improve quality financial market place infrastructure.

Financial marketplace development and deepening can only be accelerated past strengthening coordination betwixt financial market authorities and institutions. Furthermore, the fiscal marketplace authorities in Indonesia must formulate and agree a national strategy every bit a reference and course of tangible commitment for all stakeholders. To that and, Banking company Indonesia, the Ministry of Finance and the Indonesian Financial Services Authorization (OJK) established the Financial Marketplace Development and Deepening Coordination Forum (FK-PPPK).

FK-PPPK is mandated with formulating the National Financial Market Development and Deepening Strategy (SN-PPPK) every bit a comprehensive and measurable single policy framework oriented towards realising the vision of creating deep, liquid, efficient, inclusive and secure financial markets. Using a superlative-downwardly approach, therefore, FK-PPPK adult a framework based on iii main pillars as follows:

-

Sources of economic financing and risk management.

-

Market infrastructure evolution.

-

Policy coordination, regulatory harmonisation and education.

The three pillars have been elaborated into development elements for implementation beyond seven financial markets, namely the government bond market, corporate bond marketplace, coin market, strange commutation market, stock market place, structured product market and Islamic financial market.

SN-PPPK implementation has been divided into 3 stages, namely strengthening the foundations from 2018-2019, the acceleration phrase from 2020-2022 and the deepening stage from 2023-2024. [download document]

In line with the vision of the National Strategy for Financial Market Development (SN-PPPK) 2018 – 2024, which is to achieve a deep financial marketplace capable of competing globally, the Design for Money Market Development 2025 is present to complement all initiatives and implementation of SN-PPPK consisting of acceleration phase (2020 – 2022) and deepening phase (2023 – 2024) to eventually reach the desired country: a modern and advanced money marketplace in 2025.

The Blueprint for Money Market Development 2025 focuses on three initiatives: 1) promote digitalization and strengthening of financial market infrastructures, 2) strengthen effectiveness of monetary policy transmission, and 3) develop economic financing sources and risk management. These three initiatives are implemented through xiv key deliverables with various evolution and strengthening programs related to marketplace products, pricing, and participants, equally well as financial market infrastructures. It is expected that this effort will be able to increase market confidence, which may eventually realize a modern and advanced marketplace characterized by a deep, inclusive, and contributive coin market environment.

With a deep, inclusive, and contributive market environment, money market will play a significant role to increase effectiveness of monetary policy manual, thereby supporting monetary stability and fiscal system stability. It is expected that this condition enables money market every bit a catalyst to provide financing sources in order to meet the national development requirements. Consequently, coin market contributes to the accomplishment of the vision toward a Developed Indonesia.[download blueprint]

Fair, regulated, transparent, liquid and efficient financial markets with integrity can exist realised through reliable and integrated financial market place infrastructure.

One form of fiscal market infrastructure is the means to implement transactions through a platform to set prices and interact with Market Participants as follows:

- Electronic Trading Platform, namely a business entity established specifically to provide certain facilities used to collaborate and/or transact in the money market and/or foreign exchange market.

- Money Market and Foreign Exchange Market Brokers, namely a business entity established specifically to provide sure transaction facilities for service users and earn a return on the services provided.

- Systematic Internalisers, namely banks that provide certain facilities to perform transactions in the money market and/or strange exchange market using its own account with Service Users.

- Futures Commutation Providers, namely futures exchanges in accordance with prevailing laws on bolt futures trading, providing specific facilities for service users to transact in the money market and/or foreign exchange market place.

Providers of applied science and other transaction facilities must comply with good governance and effective hazard management procedures in club to create fair, regulated, transparent, liquid and efficient financial markets with integrity. Good governance is achieved through adherence to the market code of conduct, protecting the service users and increasing price transparency.

Transaction facilities have developed apace in line with technological advancement. Consequently, various new culling transaction mechanisms based on electronic systems take emerged for utilise by Market Participants.

Because the rapid development of technology in terms of providing novel transaction facilities, coupled with the importance of maintaining good governance as well as encouraging constructive risk management, provisions apropos Transaction Service Providers are required in the course of Banking concern Indonesia Regulations.

-

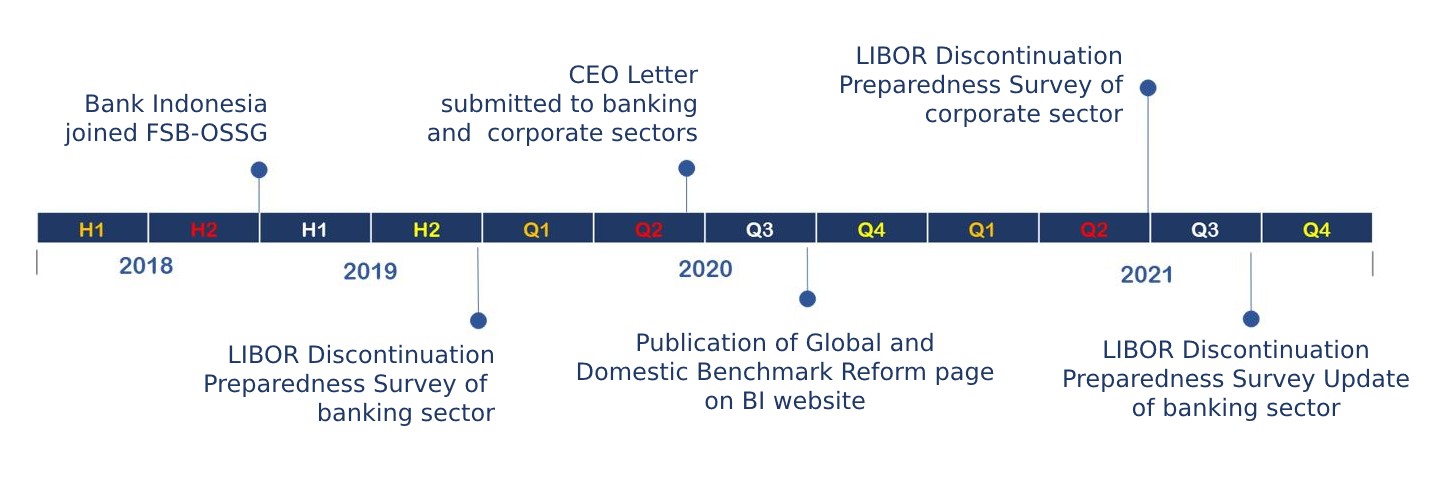

Timeline

In conjunction with other financial market authorities, Bank Indonesia has communicated the LIBOR transition to all domestic market players. The timeline of the LIBOR transition is as follows:

-

LIBOR Discontinuation Preparedness Survey

a. Survey of Banking Sector

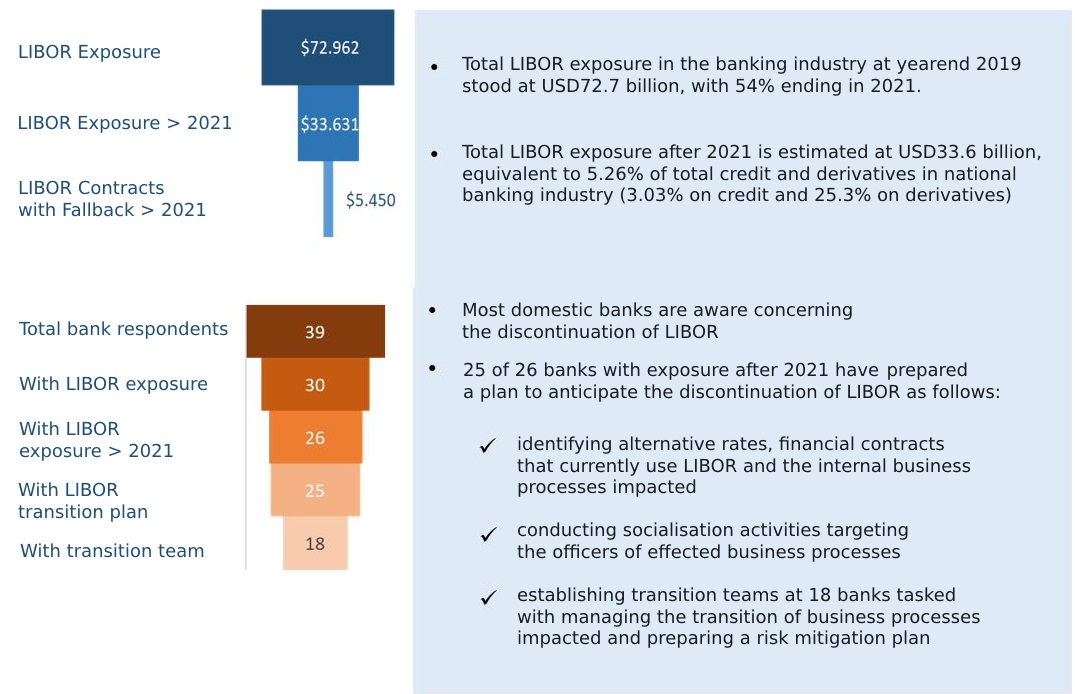

Banking company Indonesia has surveyed the banking sector to identify LIBOR use in the domestic fiscal markets. The survey revealed LIBOR exposure in the banking industry equally well as banking manufacture preparedness for the discontinuation of LIBOR.

In total, 39 domestic banks actively transacting foreign currencies were surveyed, representing 86% of exposure to foreign currency loans, rupiah loans and strange currency derivatives. The salient results of the survey are as follows:

b. Survey of Non-Fiscal Corporations

At the end of 2020, Bank Indonesia surveyed non-financial corporations with loftier foreign exchange exposure. With respondents totalling 219 corporations, just eleven% or 23 corporations were affected by LIBOR exposure. Of the 23, most (seventy%) were notwithstanding to transition due to insufficient data. Meanwhile, some of the other corporations had identified financial contracts with LIBOR exposure but were yet to transition.

-

CEO Letter

Bank Indonesia has increased the preparedness of market place players for the discontinuation of LIBOR by sending a CEO Letter of the alphabet to all banks and several corporations in June 2020. Through the CEO Letter, Bank Republic of indonesia reminded domestic banking industry and corporate sector leaders to undertake the following anticipatory measures:

- Identifying fiscal contracts using LIBOR

- Preparing contingency plans for the financial contracts using LIBOR through additional fallback clauses with relevant counterparties

- Actively restricting LIBOR use in new financial contracts

- Analysing the actions necessary in the business processes impacted every bit part of the hazard mitigation plan

- Documenting governance of the LIBOR transition

-

National Working Group

In line with FSB-OSSG recommendations and in anticipation of LIBOR discontinuation, Bank Indonesia has coordinated with other domestic fiscal market authorities, namely the Financial Services Authority (OJK) and Ministry building of Finance, every bit well as engaged in dialogue with industry associations represented by the Republic of indonesia Foreign Exchange Market Committee (IFEMC).

Close coordination and cooperation betwixt domestic fiscal market authorities represent an important strategic measure to safeguard the massive and measured anticipatory measures required towards LIBOR discontinuation.

In November 2020, the coordination forum agreed to establish a National Working Group to jointly overcome the LIBOR transition challenges, covering legal, accounting, revenue enhancement, risk management and infrastructure organization aspects.

Source: https://www.bi.go.id/en/fungsi-utama/moneter/pasar-keuangan/default.aspx

Posted by: woodruffthamot.blogspot.com

0 Response to "Which Of The Following U.s. Government Securities Are Classified As Money Market Instruments?"

Post a Comment